The COVID-19 pandemic is fast becoming one of the biggest threats to human lives and the global economy. With governments across the world taking preventive measures of quarantine, social distancing and travel bans, Hospitality is one of the first industries to be adversely hit. The impact is not just limited to Italy and China anymore but is increasingly visible across the globe resulting in steep decline in booking trends and occupancy rates.

Impact on US Hotels

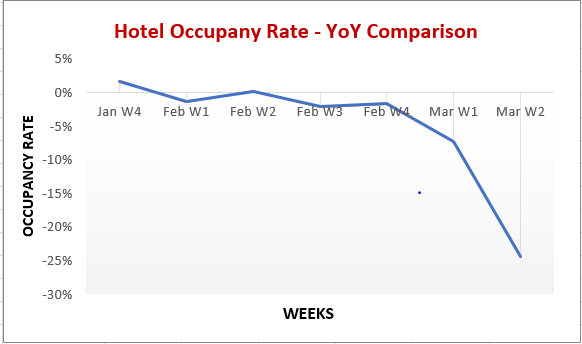

The United States has seen an exponential growth in the number of COVID-19 cases in the past couple of weeks. The impact on hotels can be seen in the below chart.

*Data from STR research

*Data from STR research

The trends clearly indicate a continuous decline of room occupancy with a steep change over first two weeks of March. As of 2nd week of March, the industry reported a YoY decline of

- 24.4% in Occupancy

- 10.7% in Average Daily Rate (ADR) and

- 32.5% in Revenue per available room (RevPAR).

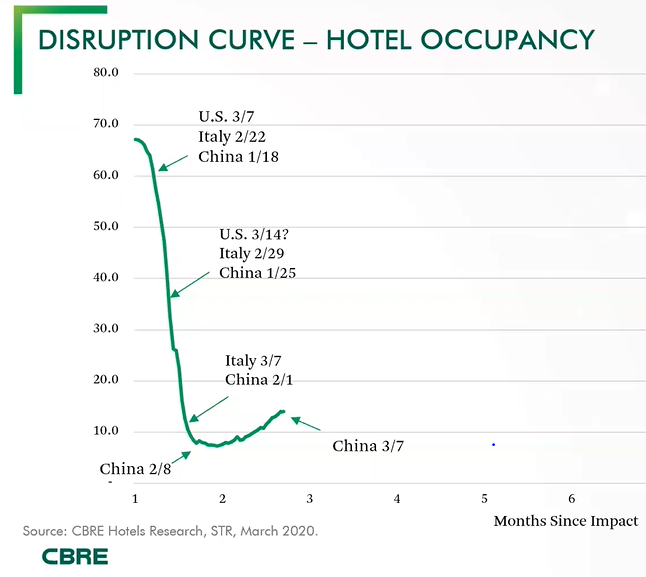

Based on the research done by CBRE (Coldwell Banker Richard Ellis), below is the depiction of expected trends for US.

US is 2 weeks behind Italy and 8 weeks behind China in terms of being affected by the pandemic

If China and Italy are any indication on how the pandemic and its subsequent impact spreads, the major disruption is observed within the first 3 months. For the United States hotel industry, this translates to a steep fall in the occupancy rates reaching 25% to 30% in March and 10% to 15% in April.

A study by hotel AVE estimates that 15% to 20% of the hotels in the United States will close temporarily by the end of March because the fixed carry costs are less than the negative cash flow projected from staying open. While this might be true for certain properties, other hotels and properties are taking some temporary measures to reduce operational costs which include

- Shutting down of floors

- Cutting down on amenities and services

- Cutting down and closing of F&B outlets

- Encouraging hotel staff to go on unpaid vacation

Irrespective of the measure the properties undertake, there is a high risk of 10% properties to have a permanent shut down as they would not be able to sustain this period.

Past Demand Shocks – An Overview:

- 2001- During the recession of 2001-02, there was a noted decline in RevPAR by an alarming 10.2%

- 2008 -The period of 2008-09 saw the RevPAR plummet down by a shocking 16.8%.

- 2002 – The 2002 SARS outbreak saw occupancy rate decline by a 26% in a comparison between the April-June quarter in 2002 and 2003.

- 2013-2014 – The Ebola crisis saw a 15% decline in room occupancy rate in sub-Saharan Africa between 2013 and 2014.

The recession periods resulted in a slump in the consumer surplus and leisure travels took the hardest hit. In addition, with increased number of lay-offs, people undertaking business travels were also curtailed.

In contrary, during the SARS or the Ebola outbreaks, there was a consumer surplus, but also an aversion to travel because of perceived hygiene and safety issues.

How does COVID-19 outbreak compare to the past demand shocks?

- Vs SARS/Ebola: The first difference is the sheer scale of COVID-19’s impact. Ebola and SARS epidemics were contained in certain geographical areas, but COVID-19, due to its highly contagious nature, has now permeated across the globe.

- Vs Recession: Recession periods tend to have a time lag between the actual onset and the start of decline in revenue for the hotel and other industries.

For COVID-19, the impact was instantaneous. In case there is a steady recovery from COVID-19 outbreak, the impact on hotel industry may not linger on for the whole year. But, it must be noted, that with the scale of economic loss across industries (and given that 2020-21 was already susceptible to a recession in the organic cycle of the business), there is a slight chance that as the COVID-19 outbreak is subdued, it may lead to a prolonged recession – which will in turn result in more losses for the hotel industry.

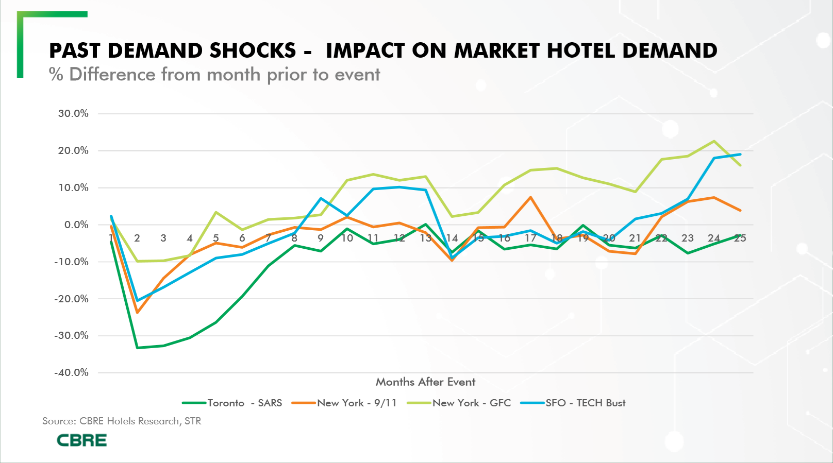

Time of Recovery in Past Demand Shocks:

In case of prior demand shocks like SARS or Financial crisis, there were at least two quarters before an indication of recovery was shown – in the form of positive monthly growth of occupancy rate.

It also must be brought to attention that metrics like Demand and Occupancy recovered earlier than revenue related attributes like ADR or RevPAR, indicating aggressive marketing and discounting of room prices to get traffic into the hotels.

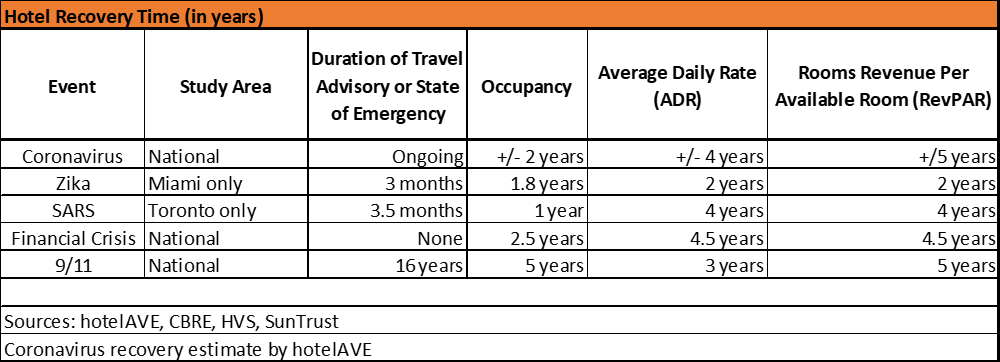

Following table summarizes the time of recovery that was exhibited by prior demand shocks:

Road to Recovery

Given that the revenue hit almost zero, most hotel businesses are focusing on reducing costs, and pursuing alternate ways of generating revenue to keep the properties up and running – eg: As some countries lift their lockdown with a mandate of 14-day quarantine period on the incoming travelers, hotel chains are offering quarantine zones for these travelers to ensure footfall. Similar avenues can be approached by other hotel chains to make sure that they do have some revenues trickling in through these tough times.

Once the situation returns to normal, we may see some consolidation amongst the hotel chains, especially amongst the boutique hotels. Businesses would be forced to take a hard look at any new investment they make, and they will be looking at ways to optimize cost.

To nudge customers into their travel patterns, we will see a co-opetition, where all the companies in an industry work together to benefit the industry.

We will witness a lot of re-defining of brands through AI and automation– e.g. Employ innovative usage of Internet of Things (IoT) to enable mobile check-in. This can be leveraged to give a zero-contact experience to the guests thus ameliorating their fears over the disease and its transmission.

Post-recovery, the landscape of the hotel industry will go through a massive overhaul. Given that urban hotels have been hit harder than their rural and sub-urban counterparts, we may see some of the urban properties going into a partial or total lockdown to recuperate some of the loss. Smaller hotel chains may be acquired by the hotel industry giants like Marriott, Hilton etc.

Overall, it is predicted that the world economy, despite taking a severe blow, will be back in positive direction in a years’ time, and will take around 3-4 years to completely nullify the losses accrued during this period.

What do you think? We would like to know your opinion.

Sources – STR, CBRE, hotelAVE

Co-authors : Akshay Subramanian <akshay.s@tredence.com> and Anik Mukherjee <anik.mukherjee@tredence.com>

AUTHOR - FOLLOW

Viswanath RT

Associate Principal

Topic Tags

Next Topic

ML Ops: Key to accelerated business outcomes and increased last- mile adoption

Next Topic